Depending on whether your company is VAT registered or not, you would need to ensure that the standard VAT percentage rate is configured correctly.

Configuring VAT Codes

The VAT code must always be configured with the standard VAT percentage and also Zero VAT percentage.

NOTE: When integrating with your accounting system, you must use a VAT that exists in that system. e.g. if you are integrating with SageOne, then the VAT entries you use must have a valid SageOneID. For Pastel, the codes must exist in Pastel.

As per the current situation, the 15% VAT is now applicable as from the 1 April 2018. However we are still allowing the use of the 14% VAT until the 30 April 2018.

Please note that after the 30 April, the 14% VAT rate should be disabled and no longer used.

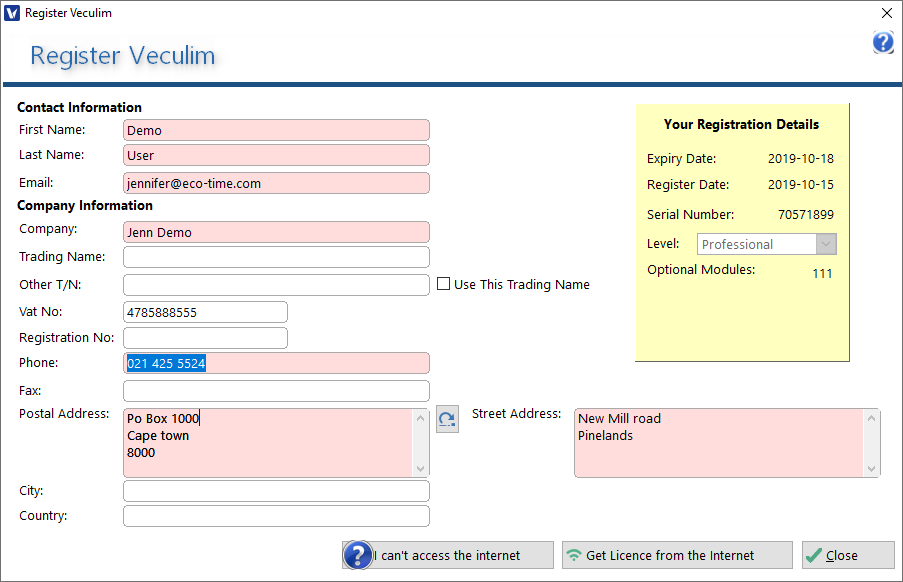

In order for you to set the default VAT code to the Standard Rate, you would need to ensure that a VAT number is filled in on the ProductRegistration window.

This window can be found in the Security Tab under Product Registration. Once you have filled in the VAT number, you would need to request a new activation code.

Please note that the default code will now be displayed in red.

VAT Codes

Depending on whether your company is VAT registered or not, you would need to ensure that the standard VAT percentage rate is configured correctly.

Configuring VAT Codes

The VAT code must always be configured with the standard VAT percentage and also Zero VAT percentage.

NOTE: When integrating with your accounting system, you must use a VAT that exists in that system. e.g. if you are integrating with SageOne, then the VAT entries you use must have a valid SageOneID. For Pastel, the codes must exist in Pastel.

As per the current situation, the 15% VAT is now applicable as from the 1 April 2018. However we are still allowing the use of the 14% VAT until the 30 April 2018.

Please note that after the 30 April, the 14% VAT rate should be disabled and no longer used.

In order for you to set the default VAT code to the Standard Rate, you would need to ensure that a VAT number is filled in on the Product Registration window.

This window can be found in the Security Tab under Product Registration. Once you have filled in the VAT number, you would need to request a new activation code.

Please note that the default code will now be displayed in red.